| Cboe Global Markets, Inc. | (Name of Registrant as Specified In Its Charter) | | (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | Payment of Filing Fee (Check all boxes that apply): | ☒ | No fee required | ◻ | Fee paid previously with preliminary materials | ◻ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | | |

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION - DATED MARCH 15, 2024

20222024

Notice of Annual Meeting of Stockholders and Proxy Statement

March 31, 2022April [_], 2024

Dear Cboe Stockholder: We cordially invite you to attend the 20222024 Annual Meeting of Stockholders (the “Annual Meeting”) of Cboe Global Markets, Inc. to be held on Thursday, May 12, 2022,16, 2024, at 9:8:00 a.m., Central time. The Annual Meeting will be a completely virtual meeting of stockholders and there will be no physical meeting location. You will be able to attend the Annual Meeting, vote your shares and submit questions during the meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/CBOE2022CBOE2024 and entering the 16-digit control number included in your proxy materials or on your proxy card. The live audio webcast of the Annual Meeting will also be available for listening to the general public. At the Annual Meeting, you will be asked to do the following:  elect 14 elect 14 Elect 12 directors to the Board of Directors to hold office until the next Annual Meeting of Stockholders or until their respective successors have been elected and qualified; Elect 12 directors to the Board of Directors to hold office until the next Annual Meeting of Stockholders or until their respective successors have been elected and qualified;

approve, approve, Approve, in a non-binding resolution, the compensation paid to our executive officers; Approve, in a non-binding resolution, the compensation paid to our executive officers;

ratify ratify Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 20222024 fiscal year;

Advisory vote on a management proposal to provide stockholders the right to call a special meeting of stockholders at a 25% ownership threshold; Advisory vote on a management proposal to provide stockholders the right to call a special meeting of stockholders at a 25% ownership threshold;

Advisory vote on a stockholder proposal to provide stockholders the right to call a special meeting of stockholders at a 10% ownership threshold; and Advisory vote on a stockholder proposal to provide stockholders the right to call a special meeting of stockholders at a 10% ownership threshold; and

transact transact Transact any other business that may properly come before the meeting and any adjournments and postponements of the meeting. Transact any other business that may properly come before the meeting and any adjournments and postponements of the meeting.

Enclosed with this letter are a formal notice of the Annual Meeting, a proxy statement, and a form of proxy. Please carefully review the form of proxy that you receive to confirm that it reflects all of your shares of our stock. If you hold stock in different accounts, you may need to complete multiple proxy cards to vote all of your shares. Whether or not you plan to attend the Annual Meeting via live audio webcast, it is important that your shares be represented and voted. Please submit your proxy by Internet or telephone, or complete, sign, date and return the enclosed proxy using the enclosed postage-paid envelope. The enclosed proxy, when returned properly executed, will be voted in the manner directed in the proxy. We hope that you will participate in the Annual Meeting, either via live audio webcast or by proxy. | Sincerely, | |

| | Edward T. Tilly[__]

| | William M. Farrow, III | | Chairman President and Chief Executive Officer |

Cboe Global Markets, Inc. NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 20222024 Annual Meeting of Stockholders (the “Annual Meeting”) of Cboe Global Markets, Inc. will be held on Thursday, May 12, 2022,16, 2024, at 9:8:00 a.m., Central time. The Annual Meeting will be a completely virtual meeting of stockholders. You will be able to attend the Annual Meeting, vote your shares and submit questions during the meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/CBOE2022CBOE2024 and entering the 16-digit control number included in your proxy materials or on your proxy card. Online check-in to the Annual Meeting live audio webcast will begin at 8:7:45 a.m., Central time, and you are encouraged to allow ample time to log in to the meeting webcast and test your computer audio system. There will be no physical meeting location. The purpose of the Annual meeting is to: | 1. | Consider and act upon a proposal to elect 1412 directors named in the proxy statement to the Board of Directors to hold office until the next Annual Meeting of Stockholders or until their respective successors have been elected and qualified; |

| 2. | Consider and act upon a non-binding resolution to approve the compensation paid to our executive officers; |

| 3. | Consider and act upon the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the 20222024 fiscal year; and |

| 4. | Advisory vote on a management proposal to provide stockholders the right to call a special meeting of stockholders at a 25% ownership threshold; |

| 5. | Advisory vote on a stockholder proposal to provide stockholders the right to call a special meeting of stockholders at a 10% ownership threshold; and |

| 6. | Transact any other business that may properly come before the meeting and any adjournments or postponements of the meeting. |

You are entitled to vote online during the Annual Meeting and any adjournments or postponements of the meeting if you were a stockholder of record at the close of business on March 17, 2022.21, 2024. A list of stockholders of record will be open for examination by any stockholder for any purpose germane to the Annual Meeting for a period of 10 days prior to the Annual Meeting at our principal executive offices at 433 West Van Buren Street, Chicago, Illinois 60607, and online during the Annual Meeting live audio webcast.60607. Your vote is important. Whether or not you plan to attend, please vote as soon as possible. For additional details, please see the information under “How“How do I vote?” in the proxy statement. | | | | | | | | | | Internet | | | Internet | | | Telephone | | | Mail | Before the Meeting

| | | During the Meeting

| | |

| | |

| Go to www.proxyvote.com | | | Go to www.virtualshareholdermeeting.com/CBOE2022CBOE2024 | | | Call toll free 1-800-690-6903 | | | Complete, sign, date and return the enclosed proxy using the enclosed postage-paid envelope | | | | By Order of the Board of Directors, | |

| | [__] | | Patrick Sexton | March 31, 2022April [__], 2024

| Corporate Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 12, 2022:May 16, 2024: The noticeNotice of the Annual Meeting and proxy statementProxy Statement are available on theour Investor Relations section of our website at http://ir.Cboe.com.

TABLE OF CONTENTS We are furnishing this Proxy Statement to you in connection with a solicitation of proxies by the Board of Directors of Cboe Global Markets, Inc., a Delaware corporation, for use at the Cboe Global Markets, Inc. 20222024 Annual Meeting of Stockholders on Thursday, May 12, 202216, 2024 at 9:8:00 a.m., Central time, and at any adjournments or postponements thereof. The approximate date on which this Proxy Statement and the accompanying form of proxy are first being sent to stockholders is March 31, 2022.April [_], 2024.

Except as otherwise indicated, the terms “the Company,” “Cboe Global Markets,” “we,” “us” and “our” refer to Cboe Global Markets, Inc. When we use the term “Cboe“Cboe Options” or “C1” we are referring to Cboe Exchange, Inc., a wholly owned subsidiary and predecessor entity of Cboe Global Markets. On February 28, 2017, we closed our acquisition Note About Forward-Looking Statements This Proxy Statement contains historical and forward-looking statements within the meaning of Bats Global Markets, Inc. (“Bats”). In 2020, we purchased Hanweck Associates, LLC (“Hanweck”)the Private Securities Litigation Reform Act of 1995 that involve a number of risks and uncertainties. You can identify these statements by forward-looking words such as ”may,”" “might,” ”should,” ”expect,” “plan,” “anticipate,” ”believe,” ”estimate,” ”predict,” ”potential” or ”continue,” and the assetsnegative of FT Providers, LLC (“FT Options”),these terms and other comparable terminology. All statements that reflect our expectations, assumptions or projections about the future other than statements of historical fact are forward-looking statements. These forward-looking statements, which are providerssubject to known and unknown risks, uncertainties and assumptions about us, may include projections of risk analytics market data,our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from those expressed or implied by the assetsforward-looking statements. In particular, you should consider the risks and uncertainties described in Part 1 of Trade Alert, LLC (“Trade Alert”)our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 under Item 1A., “Risk Factors,” and our other filings with the SEC. While we believe we have identified material risks, these risks and uncertainties are not exhaustive. Moreover, we operate in a real-time alertsvery competitive and order flow analysis service provider, European Central Counterparty N.V. (“EuroCCP”), an operator of a European clearinghouse,rapidly changing environment. New risks and TriAct Canada Marketplace LP (“MATCHNow”), an operator of an equities alternative trading system (“ATS”) in Canada. At the end of 2020, we also purchased BIDS Trading, L.P. (“BIDS Trading”), a registered broker-dealeruncertainties emerge from time to time, and operator of the BIDS ATS in the U.S., whichit is not a registered national securities exchangepossible to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or a facility thereof. In 2021, we acquired Chi-X Asia Holdings Limited (“Chi-X Asia Pacific”), a holding companythe extent to which any factor, or combination of alternative market operators and providers of innovative market solutions.factors, may cause actual results to differ materially from those contained in any forward-looking statements.

PROXY STATEMENT SUMMARY This summary highlights information contained elsewhere in this Proxy Statement for the Cboe Global Markets, Inc. 20222024 Annual Meeting of Stockholders (the “Annual Meeting”). It does not contain all of the information that you should consider in voting your shares of our common stock. Before voting, you should carefully read this entire Proxy Statement, as well as our 20212023 Annual Report to Stockholders included in this mailing, which includes a copy of our Annual Report on Form 10-K for the year ended December 31, 2021.2023. Annual Meeting Information

| | | | | | Annual Meeting Date: | | May 12, 202216, 2024 | Annual Meeting Time: | | 9:8:00 a.m. (Central time)

| Virtual Meeting Website Address: | | www.virtualshareholdermeeting.com/CBOE2022CBOE2024 | Record Date: | | March 17, 202221, 2024 |

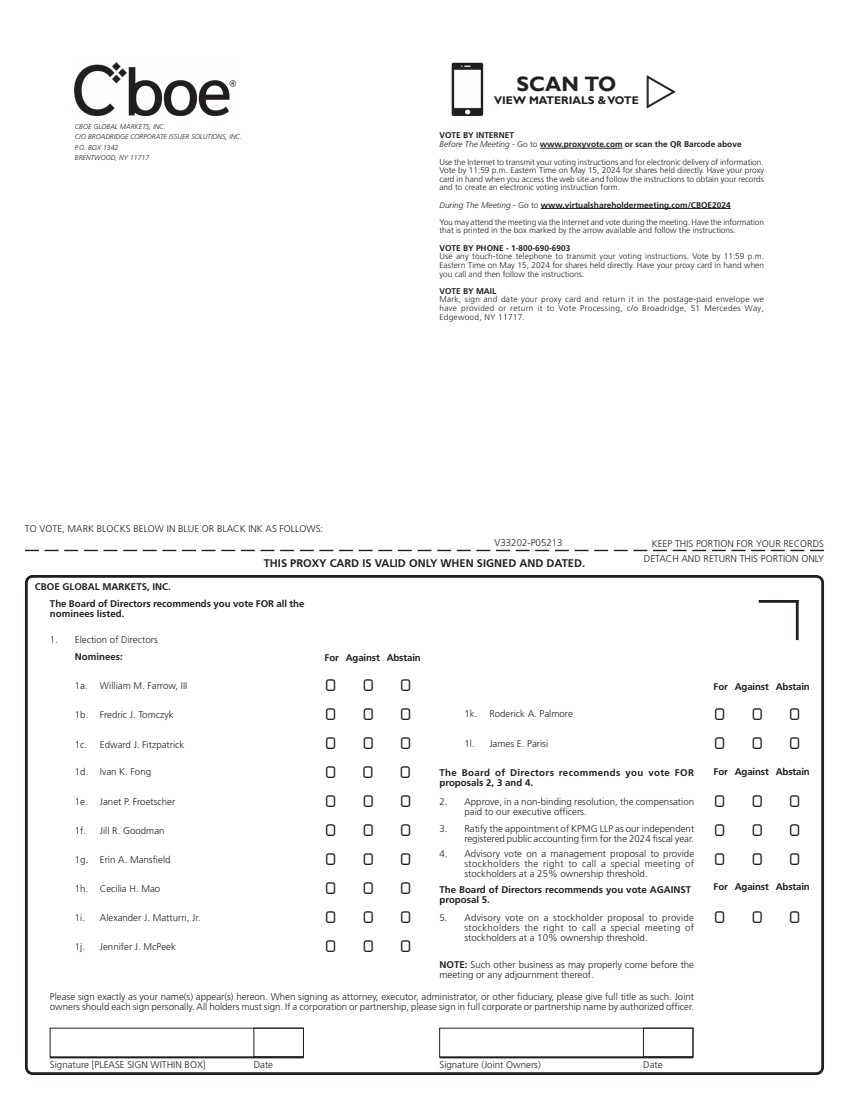

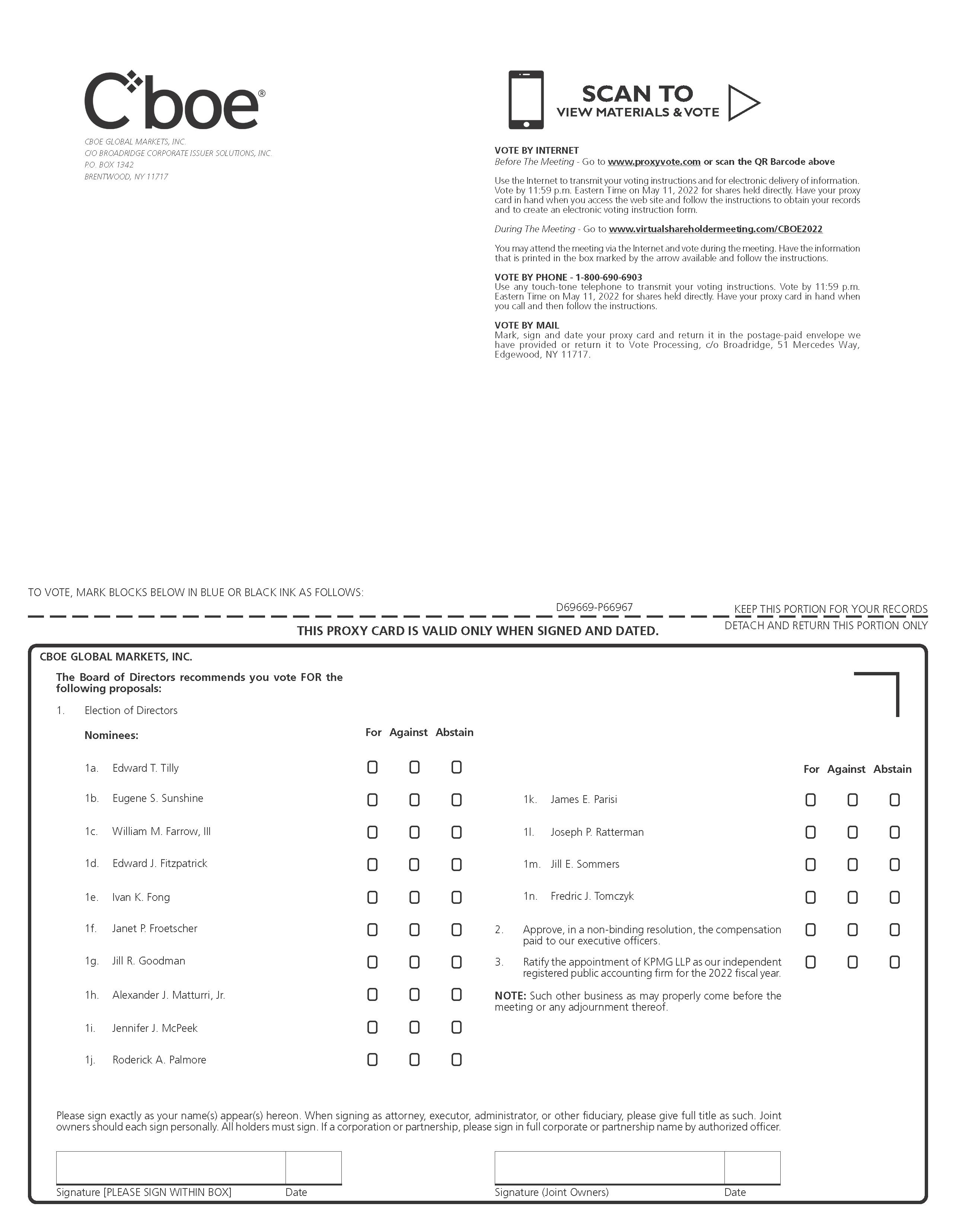

Stockholder Actions and Board of Directors Voting Recommendations | | | | | Proposal | | Board Voting

Recommendation | | Page

Reference | 1 - Elect 1412 directors to the Board of Directors | | FOR | | 56

| 2 - Approve, in a non-binding resolution, the compensation paid to our executive officers | | FOR | | 3334

| 3 - Ratify the appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the 20222024 fiscal year | | FOR | | 7597

| 4 - Advisory vote on a management proposal to provide stockholders the right to call a special meeting of stockholders at a 25% ownership threshold | | FOR | | 99 | 5 - Advisory vote on a stockholder proposal to provide stockholders the right to call a special meeting of stockholders at a 10% ownership threshold | | AGAINST | | 102 |

Business Highlights | | | | Cboe Global Markets 20222024 Proxy Statement | 1 |

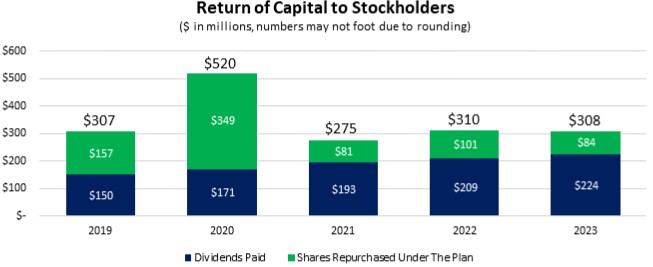

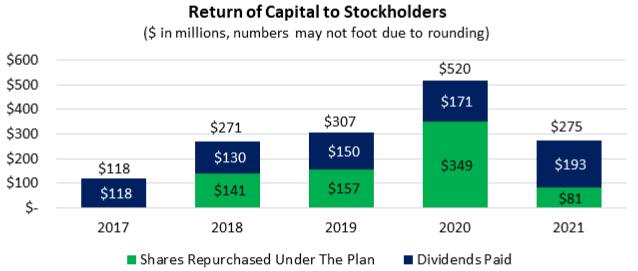

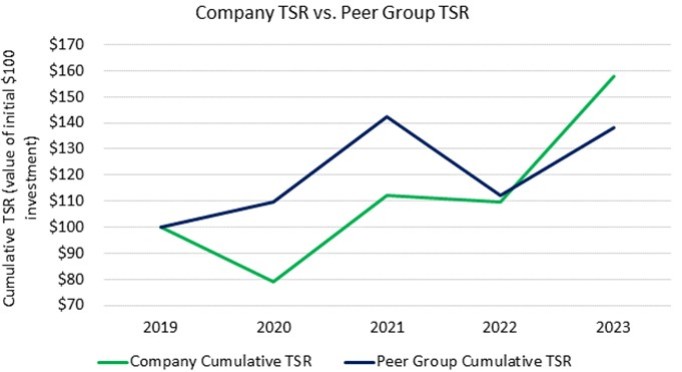

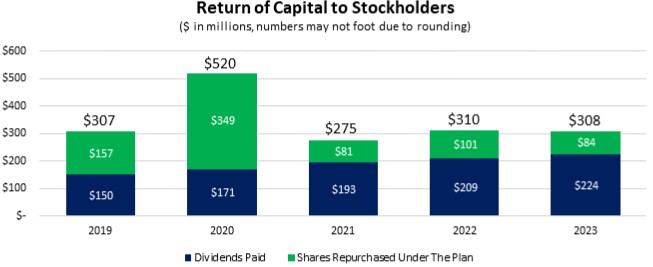

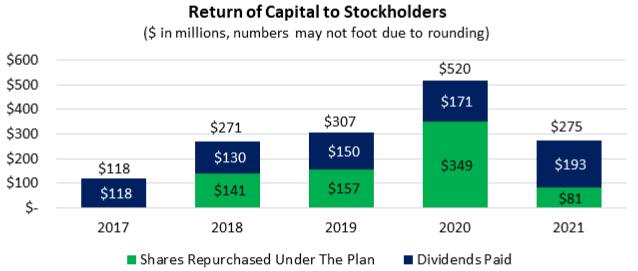

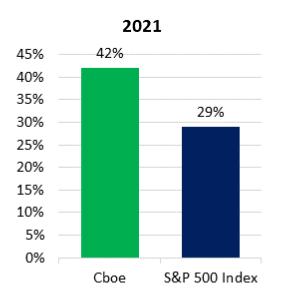

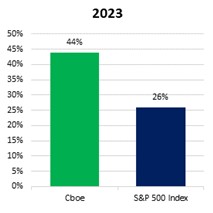

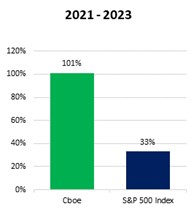

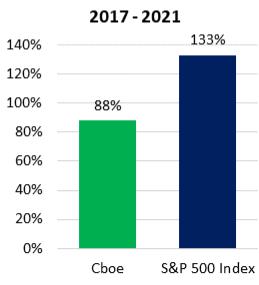

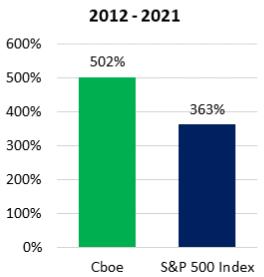

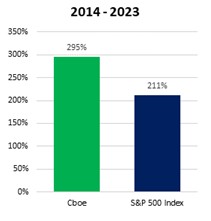

Returns to Stockholders Cboe Global Markets and its Board of Directors (“Board”) have demonstrated an ongoing commitment to creating long-term stockholder value and produced the following notable returns to stockholders in 2021.2023.

| (1) | As of December 31, 2023. Includes reinvestment of all dividends. |

1As of December 31, 2021. Includes reinvestment of all dividends.

| | | 2 | Cboe Global Markets 20222024 Proxy Statement | |

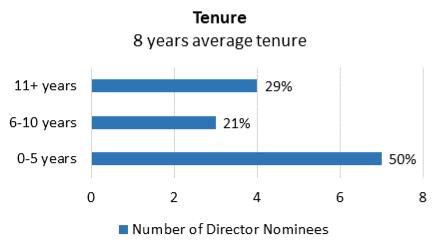

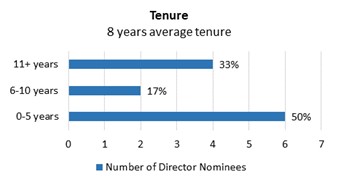

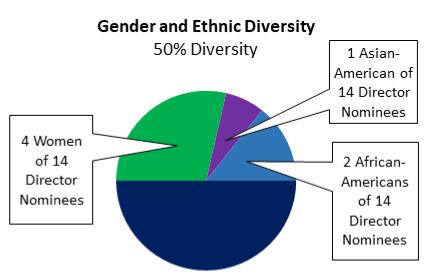

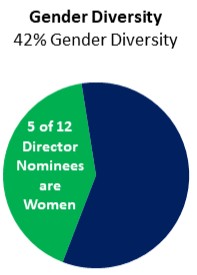

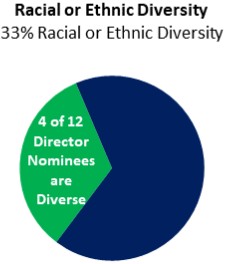

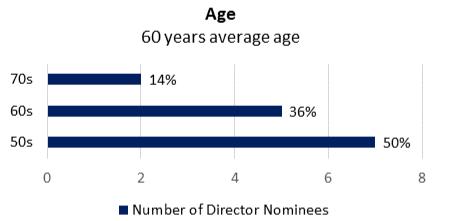

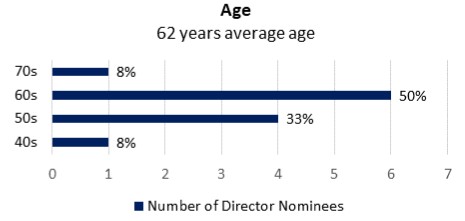

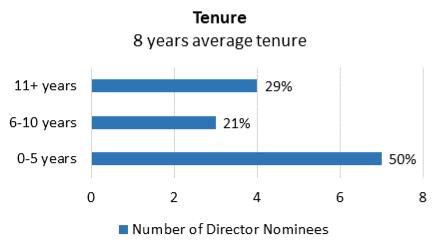

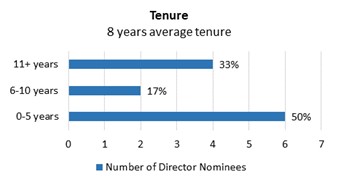

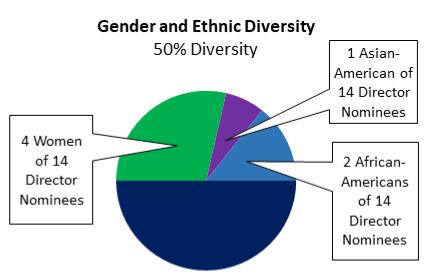

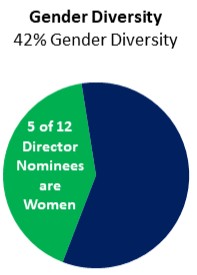

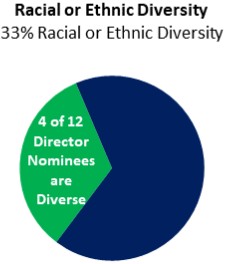

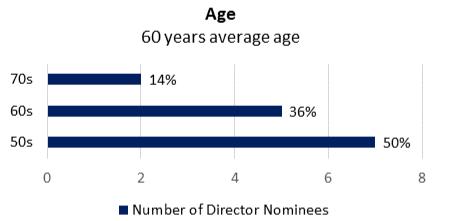

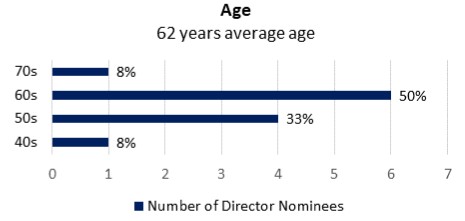

Director Nominee Highlights1 The nominees for our Board exhibit an effective mix of qualifications, experiences and diversity. For additional information, see “Corporate Governance—Proposal 1- Election of Directors”.

|

|

| |

| |

1Certain highlights are based on self-identified characteristics.

| |

| | | | Cboe Global Markets 20222024 Proxy Statement | 3 |

Corporate Governance Highlights We are committed to good corporate governance, which promotes the long-term interests of stockholders by providing for effective oversight and management of the Company. The following are highlights of our corporate governance framework. For additional information, see “Corporate Governance”:.

Stockholder Engagement Highlights Cboe Global Markets and our BoardWe are also committed to fostering long-term and institution-wide relationships with stockholders and maintaining their trust and goodwill. Through a variety of engagement activities, and our 2021 Investor Day, our discussions with stockholders cover a variety of topics, including our performance, strategy, corporate governance,ESG, and executive compensation. For additional information, seeSee also “Corporate Governance—Stockholder Engagement”.

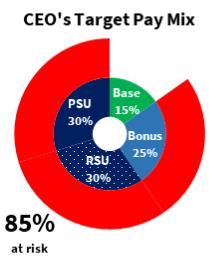

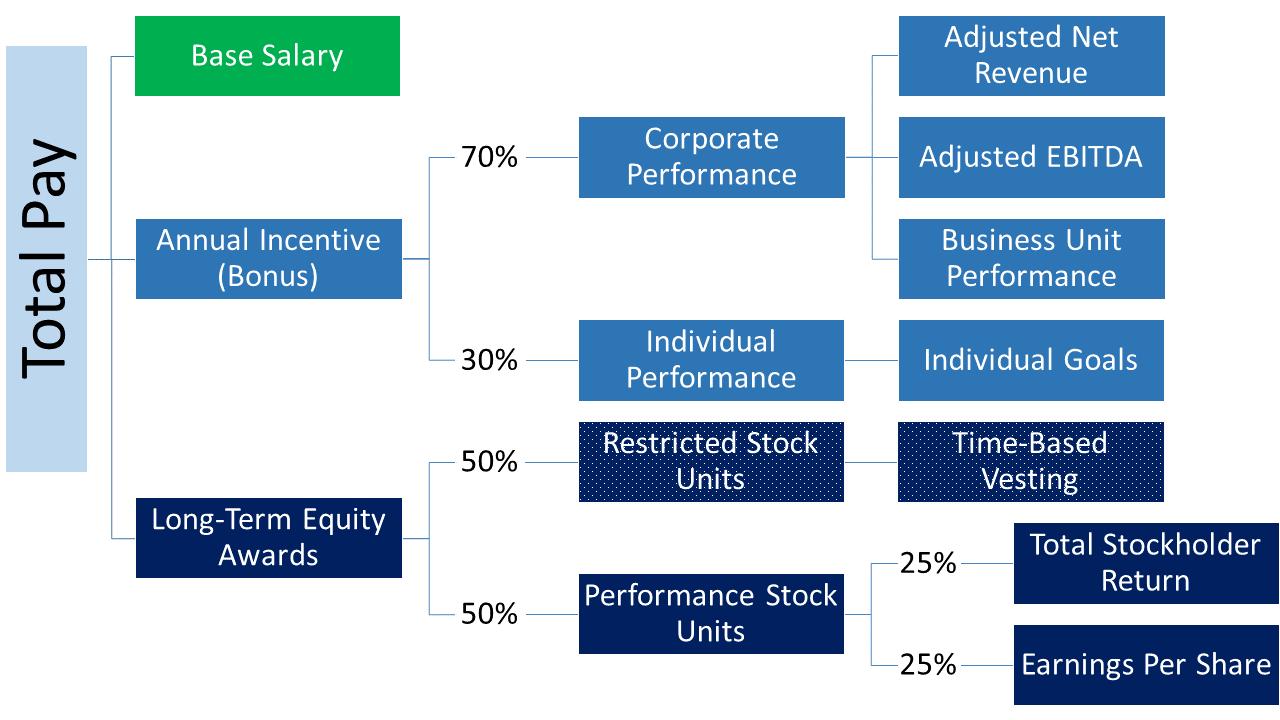

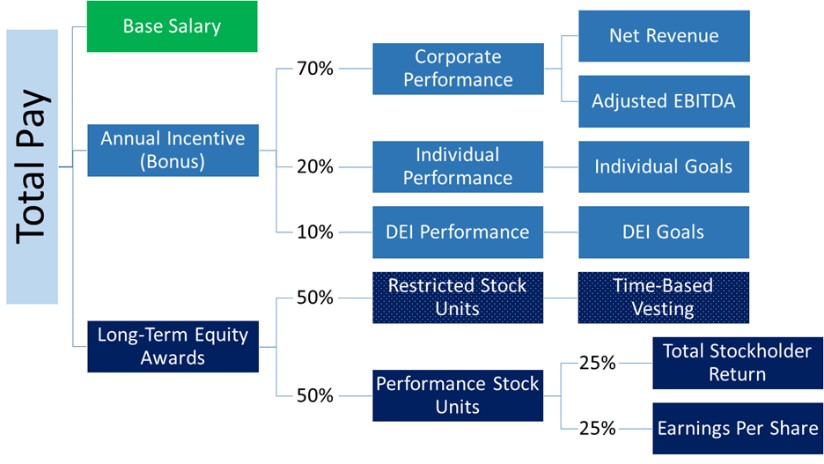

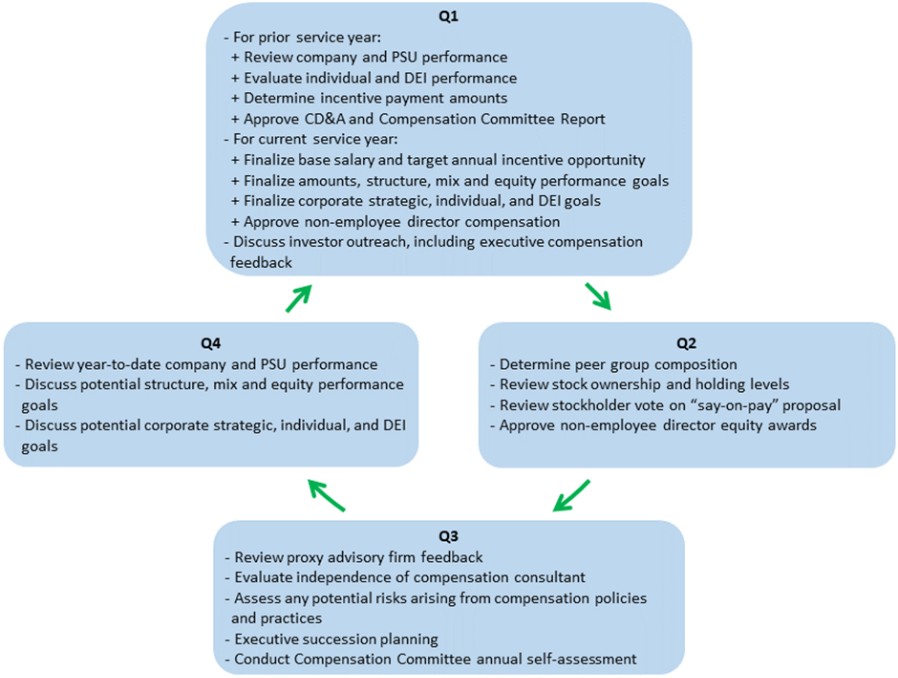

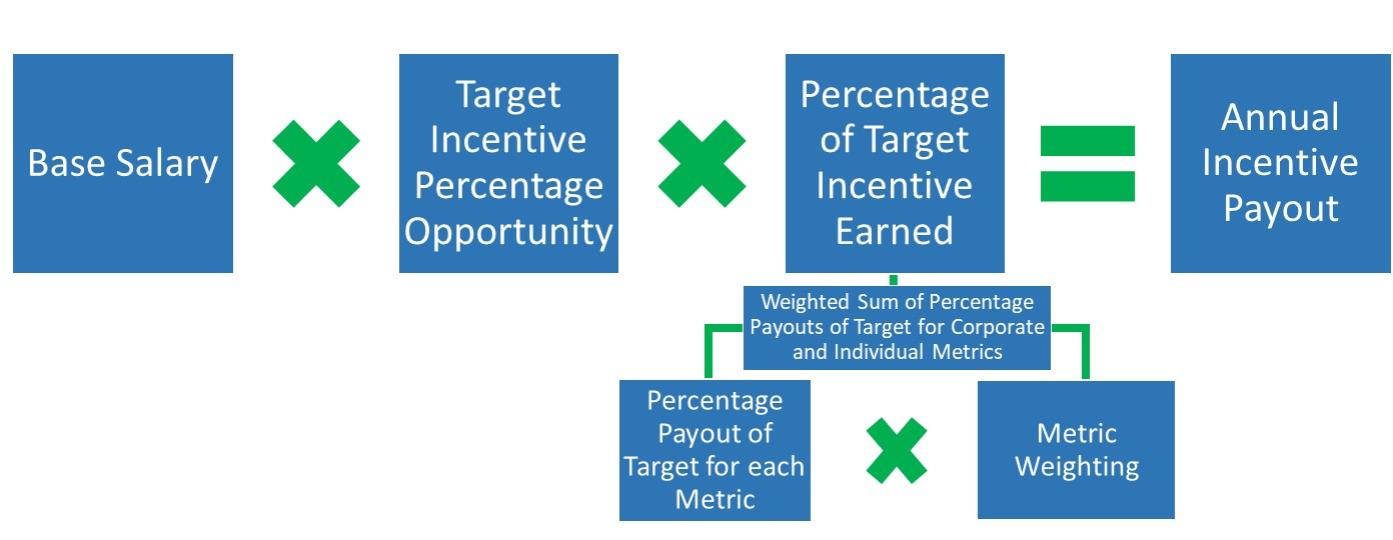

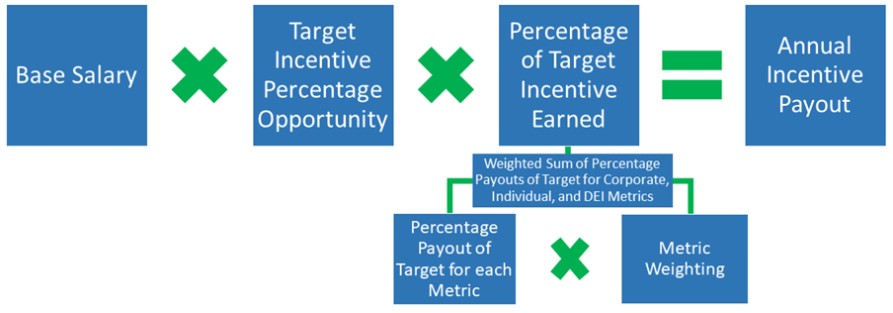

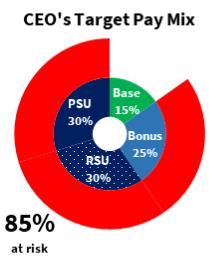

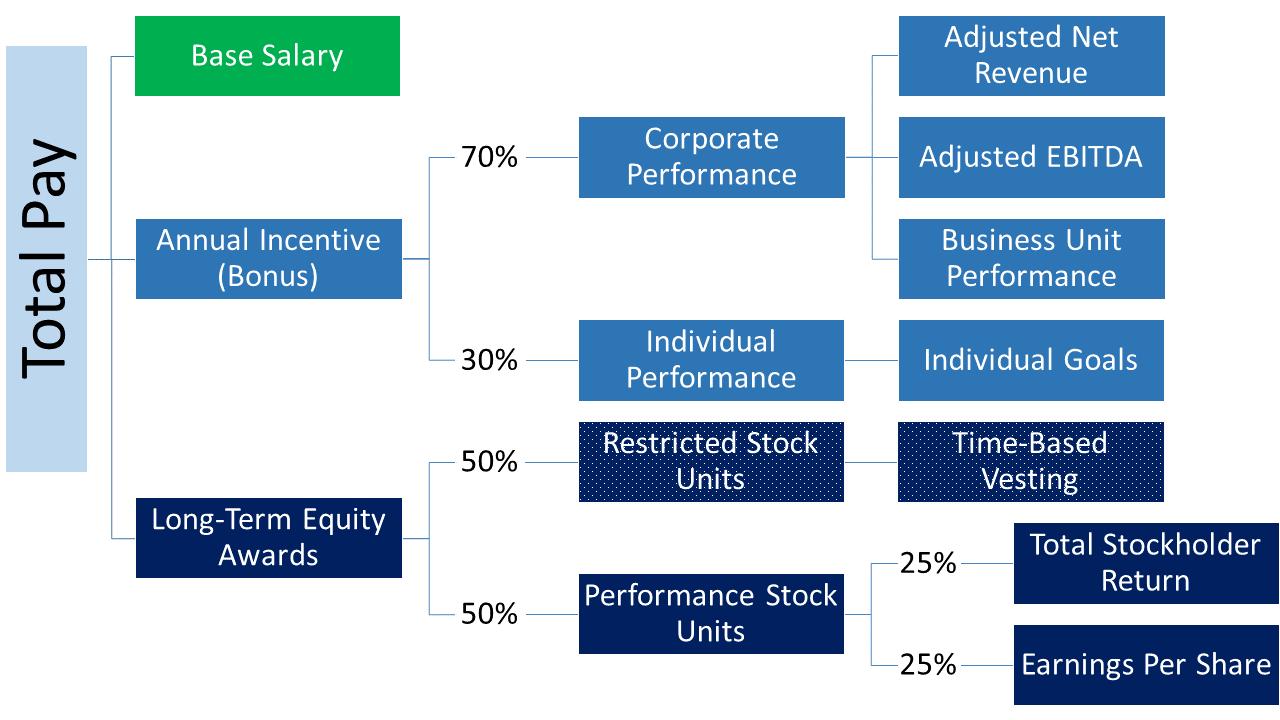

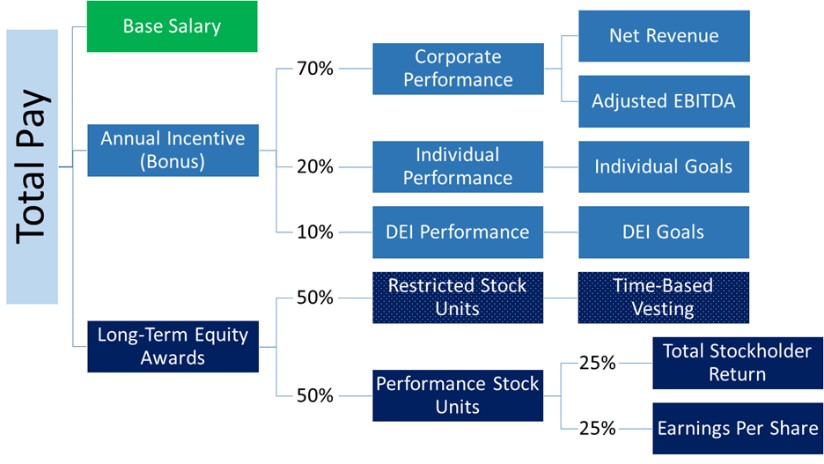

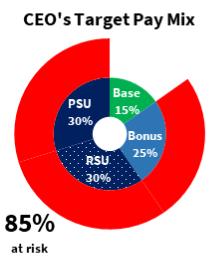

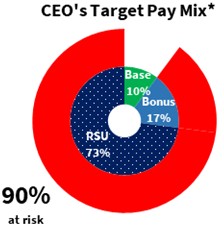

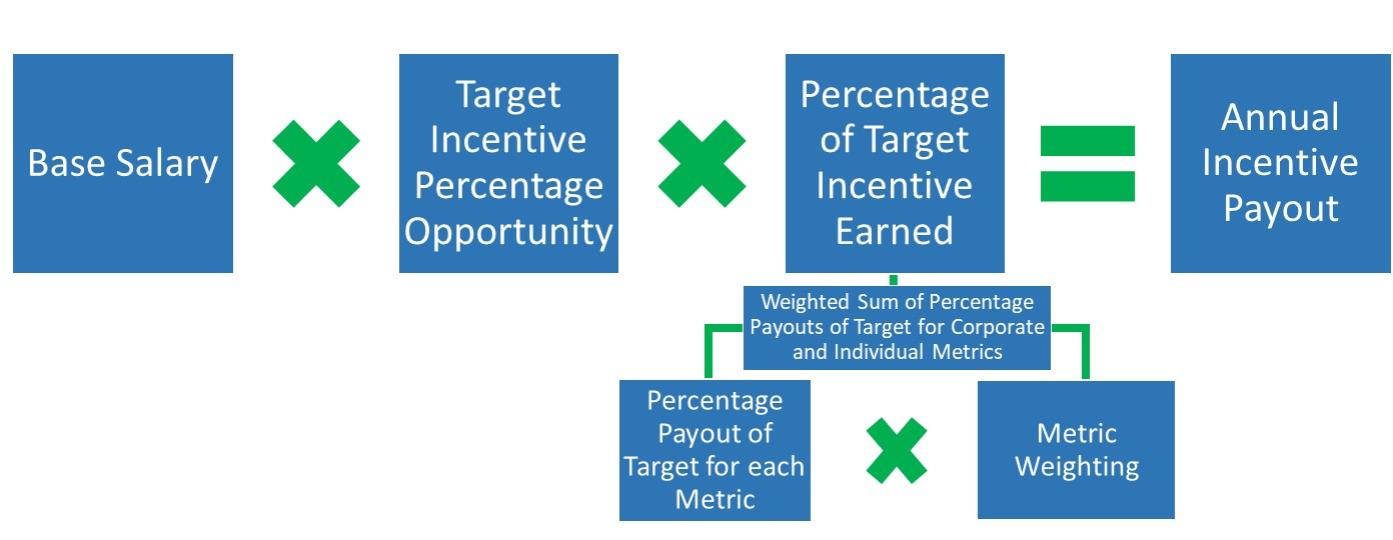

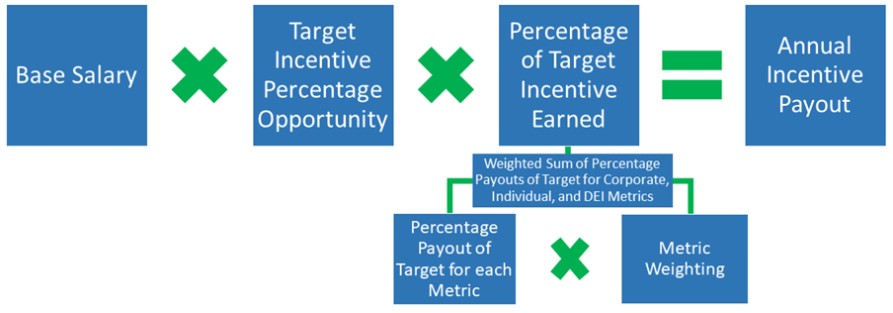

Executive Compensation Highlights The design of our executive compensation program, including compensation practices and independent oversight, is intended to align management’s interests with those of our stockholders. The following are highlights of our 20212023 executive compensation program, which is described in further detail in this Proxy Statement underprogram. See also “Executive Compensation”:.   Annual cash incentives were based on corporate performance (weighted 70%) Annual cash incentives were based on corporate performance (weighted 70%) and, individual performance (weighted 30%20%), and DEI performance (weighted 10%);

Long-term Long-term incentive wasincentives in the form of equity awards, other than special one-time grants to Mr. Schell and Ms. Clay and a CEO appointment grant to Mr. Tomczyk, were comprised of 50% time-based restricted stock units (“RSUs”) and 50% performance-based restricted stock units;RSUs (“PSUs”);

Performance-based compensation with limits on all incentive award payouts; Performance-based compensation with limits on all incentive award payouts;

No excessive perquisites; No excessive perquisites;

Clawback provisions for cash incentives and equity awards; and Clawback provisions for cash incentives and equity awards; and

Mandatory stock ownership and holding guidelines. Mandatory stock ownership and holding guidelines.

| | | 4 | Cboe Global Markets 2024 Proxy Statement | |

Additional Information Please see the information under “Other Items” for important information about this Proxy Statement, voting, the Annual Meeting, Cboe Global Markets documents available to stockholders, communications, and the deadlines to submit stockholder proposals for the 20232025 Annual Meeting of Stockholders. Additional questions may be directed to Investor Relations at investorrelations@Cboe.com or (312) 786-7559. | | | | 4

Cboe Global Markets 20222024 Proxy Statement | 5 |

CORPORATE GOVERNANCE PROPOSAL 1 - ELECTION OF DIRECTORS Board Composition Our Third Amended and Restated Certificate of Incorporation provides that our Board will consist of not less than 11 and not more than 23 directors. Our Board currently has 1412 directors. Each director is elected annually to serve until the next Annual Meeting of Stockholders or until his or her successor is elected or appointed and qualified, except in the event of earlier death, resignation or removal. Subject to retirement, there is no limit on the number of terms a director may serve on our Board. General At the Annual Meeting, our stockholders will be asked to elect the 1412 director nominees set forth below, each to serve until the 20232025 Annual Meeting of Stockholders. All of the director nominees have been recommended for election by our Nominating and Governance Committee and approved and nominated for election by our Board. In addition, with respect to Mr. Tilly, his employment agreement provides that the Company will nominate him as a director for stockholder approval at each annual meeting during his employment with us. All of the director nominees, other than Mses. Mansfield and Mao who were appointed in February 2024 and who are new nominees, were elected as directors by stockholders at the 20212023 Annual Meeting of Stockholders. All of the nominees have indicated their willingness to serve if elected. If any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, then shares represented by properly executed proxies will be voted at the discretion of the persons named in those proxies for such other person as the Board may designate. We do not presently expect that any of the nominees will be unavailable. Your proxy for the Annual Meeting cannot be voted for more than 1412 nominees. Qualifications and Experience The Board believes that the skills, qualifications and experiences of the director nominees make them all highly qualified to serve on our Board, both individually and as providing complementary skills on our Board. Based on the self-identified characteristics of our directors, 7 ofas reported in their respective directors and officers questionnaires, our director nominees bring an effective mix of diverse perspectives:  4 5 nominees are women, 5 nominees are women, Mses. Froetscher, Goodman, McPeek, and Sommers,

2 4 nominees are 4 nominees are African-Americans, Messrs. Farrow and Palmore, andracially or ethnically diverse.

1 is Asian-American, Mr. Fong.

| | | | Cboe Global Markets 2022 Proxy Statement

| 5

|

In addition, our Board’s composition represents a balanced approach to director tenure and age, 76 of the 1412 nominees have tenures equal to or less than 5 years and the ages range from 5272 to 72,49, allowing the Board to benefit from the experience of longer-serving directors combined with fresh perspectives from newer directors. The following table shows the specific qualifications and experiences the Board and the Nominating and Governance Committee considered for each nominee. | | | 6 | Cboe Global Markets 2024 Proxy Statement | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Director Qualifications and Experiences | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Company’s Mission

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Understand and adhere to the Company's mission

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| Independence

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Satisfy the independence requirements of BZX

|

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| Strategy | | | | | | | | | | | | |

|

| Experience developing and executing strategyupon long-term strategic plans, growth strategies, and capital allocation plans | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ●

| ●

| Management | | | | | | | | | | | | |

|

| Experience managing large and complex organizations at a senior level | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ●

| ●

| Financial Markets, Clearing, and our Products | | | | | | | | | | | | |

|

| Experience with the trading or clearing of derivatives, equities, FX, or digital assets and/or with our markets and the trading of derivatives and equitiesproducts | ● | ●

| ●

| | | | ●

| ●

| ● | ●

| ●

| ● | ●

| ●

| Government Relations and Regulatory | | | | | | | | | | | | |

|

| Experience and understanding of the complex regulatory environment in which our businesses operate and/or working in or with the government and regulators | ● | ● | ● | ● | ●

| | ●

| ●

| ● | ● | ● | ● | ●

| ●

| Corporate Governance | | | | | | | | | | | | |

|

| Knowledge of corporate governance matters, includingprimarily through service on other public company boards, to help support our goals of strong Board and management accountability, transparency, effective oversight, and good governance | ● | ● | ●

| ●

| ● | ● | ●

| | ●

| ● | ● | ● | International | | | | | | | | ��� | | | | | Experience in a senior leadership role in an organization with significant international operations or expansion into new international markets | ● | ● | ● | ● | ● | | ● | ● | ● | | ● | | Risk Management | | | | | | | | | | | | |

|

| Experience overseeing riskSkills and experience in assessment, oversight, and/or management of risks

| ● | ● | ● | ● | ● | ● | ●

| ● | ● | ● | ● | ● |

| ●

| Technology | | | | | | | | | | | | | ��

|

| Experience or expertise in technology assessing opportunities and risks of new technologies and/or assessing cybersecurity risks and vulnerabilities | ● | ●

| ●

| ●

| ●

| | | ●

| | | | ●

| | ●

| Fresh Perspective | | | | | | | | | | | | |

|

| Board tenure is equal to or less than five years | | ●

| | ● | | | | ● |

| | ● | ● | ●

| ●

| | ●

●

| ●

|

Nominees Set forth below is biographical information, as of March 17, 2022,15, 2024, for each of the directors nominated to serve on our Board for a one-year term until the 20232025 Annual Meeting of Stockholders, as well as the reasons why the Board believes each candidate is well suited to serve as a director. The terms indicated for service include the service on the board of Cboe Options prior to our demutualization and our initial public offering in 2010. | | | | Cboe Global Markets 2024 Proxy Statement | 7 |

In addition, as indicated below, certain director nominees also servehave served on certain boards of directors and committees of Cboe Futures Exchange, LLC (“CFE”), Cboe SEF, LLC (“SEF”) and our U.S. securities exchanges, which include Cboe Options, Cboe C2 Exchange, Inc. (“C2”), Cboe BZX Exchange, Inc. (“BZX”), Cboe BYX Exchange, Inc., Cboe EDGA Exchange, Inc., and Cboe EDGX Exchange, Inc. (collectively, the “securities exchanges”).

| | | 6

| Cboe Global Markets 2022 Proxy Statement

| |

| | Edward T. Tilly

Chairman, President and CEO

Age: 58

Committees:

Executive (Chair) Executive (Chair)

| Background

Mr. Tilly is our Chairman, President and Chief Executive Officer (“CEO”). Mr. Tilly has served as Cboe Global Markets’ President since January 2019, Chairman since February 2017 and as CEO and a director since May 2013. Prior to that, he served as our President and Chief Operating Officer from November 2011 to May 2013 and as Executive Vice Chairman from August 2006 until November 2011. He was a member of Cboe Options from 1989 until 2006, and served on its Board from 1998 through 2000, from 2003 through July 2006, and from 2013 to the present, including as Member Vice Chairman from 2004 through July 2006 and as Chairman from February 2017 to the present. Mr. Tilly currently serves on the boards of directors of our securities exchanges, Northwestern Memorial HealthCare, Working in the Schools and as Chairman of the World Federation of Exchanges. He is also a member of the Commercial Club of Chicago and the Economic Club of Chicago and a former member of the board of directors and Chairman of CFE and SEF. He holds a B.A. degree in Economics from Northwestern University.

Qualifications

Mr. Tilly has a deep understanding of the Company and the operations of our exchanges from trading on Cboe Options, representing the interests of market participants and serving in our management. He also brings significant knowledge of the global securities, futures and foreign currency exchange industries. We believe that Mr. Tilly’s experience overseeing our risk management, working with the government and regulators, successfully developing and executing our strategic initiatives, as well as being Chairman, President and CEO of Cboe Global Markets, makes him well suited to serve on our Board.

|

| | | | Cboe Global Markets 2022 Proxy Statement

| 7

|

Eugene S. Sunshine

Lead Director

Independent

Age: 72

Committees:

Executive Executive

| Background

Mr. Sunshine currently serves as our independent Lead Director and has served on the Board of Cboe Global Markets since our initial public offering in 2010 and of Cboe Options from 2003 to 2017. Mr. Sunshine retired from his position as Senior Vice President for Business and Finance at Northwestern University in August 2014, a position he had held since 1997. Prior to joining Northwestern, he was Senior Vice President for administration at The John Hopkins University. At both The John Hopkins University and Northwestern University, Mr. Sunshine was CFO. Prior to joining The John Hopkins University, Mr. Sunshine held numerous positions in New York State government, including state treasurer. He is currently a member of the board of directors of Arch Capital Group Ltd., a publicly traded company. He is a former member of the board of directors of Bloomberg L.P., Kaufman Hall and Associates, KeyPath Education, and National Mentor Holdings. He holds a B.A. degree from Northwestern University and a Masters of Public Administration degree from the Maxwell School of Citizenship and Public Affairs at Syracuse University.

Qualifications

Mr. Sunshine has extensive financial skills from his education and professional experiences. He also has knowledge of the corporate governance issues facing boards from his experience serving on them. He has extensive connections in the Chicago area business community. We believe that these skills make him well suited to serve on our Board and as our Lead Director.

|

| | | 8

| Cboe Global Markets 2022 Proxy Statement

| |

William M. Farrow, III Chairman Independent Age: 6769 Committees:  Audit Audit Executive (Chair) Executive (Chair)

Executive Executive Finance and Strategy Finance and Strategy

Risk (Chair) Risk (Chair)

| Background Mr. Farrow has served onas non-executive Chairman of the Board since September 2023, as our independent Lead Director from May 2023 to September 2023 and as a member of our Board since 2016. Mr. Farrow is the retired President and CEO of Urban Partnership Bank, a position he held from 2010 through 2017. Prior to that, he was the Managing Partner and CEO of FC Partners Group, LLC from 2007 to 2009, the Executive Vice President and Chief Information Officer of The Chicago Board of Trade from 2001 to 2007 and held various senior positions at Bank One Corporation. Mr. Farrow currently serves on the board of directors of publicly traded company WEC Energy Group, Inc. and on the boards of directors of CoBank, Inc. and the NorthShore University Health Systems. He is alsoEndeavor Health. Mr. Farrow previously was the owner of Winston and Wolfe LLC, a privately held technology development and advisory company. Mr. Farrow previouslycompany, and served on the boards of directors of the Federal Reserve Bank of Chicago, Urban Partnership Bank, and Echo Global Logistics, Inc., formerly a publicly traded company. Mr. Farrow holds a B.A. degree from Augustana College and a Masters of Management from Northwestern University’s Kellogg School of Management. Qualifications Mr. Farrow brings his experience as the retired President and CEO of a mission based community development financial institution to our Board. He has a strong understanding of information technology systems, including cybersecurity, and the financial services and banking industry. He also has knowledge of the corporate governance issues facing boards from his experience serving on them. We believe that these experiences give Mr. Farrow an important skill set that makes him well suited to serve on our Board.Board and as our Chairman. |

| | | 8 | Cboe Global Markets 2024 Proxy Statement | |

Fredric J. Tomczyk CEO Age: 68 Committees:  Executive Executive

| Background Mr. Tomczyk is our Chief Executive Officer (“CEO”) and director. He has served as our CEO since September 2023. Mr. Tomczyk served on our Board as an independent director from July 2019 to September 2023. Previously, he was President and Chief Executive Officer of TD Ameritrade Holding Corporation, a position he held from October 2008 to October 2016. Prior to this position, he held positions of increasing responsibility and leadership with the TD organization from 1999. Mr. Tomczyk was also a member of the TD Ameritrade board of directors from 2006 to 2007 and 2008 to 2016. Prior to joining the TD organization in 1999, Mr. Tomczyk was President and Chief Executive Officer of London Life. He currently serves on the board of Willis Towers Watson PLC, a publicly traded company, and is a member of the Cornell University Athletic Alumni Advisory Council. Mr. Tomczyk also previously served as the lead independent director of Sagen MI Canada Inc., a publicly traded company, and of its operating subsidiary Sagen Mortgage Insurance Company Canada, as a director of Knight Capital Group, Inc. and as a trustee of Liberty Property Trust, both formerly publicly traded companies, and as a director of the Securities Industry and Financial Markets Association. Mr. Tomczyk holds a B.S. degree in Applied Economics & Business Management from Cornell University and is a Fellow of the Institute of Chartered Accountants of Ontario. Qualifications Mr. Tomczyk’s extensive knowledge of the financial markets, technology and the financial services and banking industries gives him unique insights into our business. His prior service as TD Ameritrade’s President and Chief Executive Officer also gives Mr. Tomczyk experience with corporate governance and leadership skills, working with the government and regulators, successfully developing and executing corporate strategic initiatives and overseeing risk management programs. We believe that these experiences, as well as being our CEO, make him well suited to serve on our Board. |

| | | | Cboe Global Markets 2024 Proxy Statement | 9 |

Edward J. Fitzpatrick Independent Age: 5557 Committees:   Compensation (Chair) Compensation (Chair)

Executive Executive

Risk Risk

| Background Mr. Fitzpatrick has served on our Board since 2013. Mr. Fitzpatrick is currently Senior Vice President and Senior Client Advisor of Genpact Limited, a position he has held since August 2021, and prior to that was its Chief Financial Officer from July 2014 to August 2021. Prior to joining Genpact Limited, Mr. Fitzpatrick worked at Motorola Solutions, Inc. and its predecessors from 1998 through 2014 in various financial positions, including as its CFO from 2009 to 2013. Before joining Motorola, Mr. Fitzpatrick was an auditor at PricewaterhouseCoopers, LLP from 1988 to 1998. Mr. Fitzpatrick holds a B.S. degree in Accounting from Pennsylvania State University and an M.B.A. degree from The Wharton School at the University of Pennsylvania and earned his CPA certification in 1990. Qualifications Mr. Fitzpatrick brings his experience as the former CFO of publicly traded companies to our Board. He has extensive experience with finance, public company responsibilities and strategic transactions. We believe that these experiences give Mr. Fitzpatrick an important skill set that makes him well suited to serve on our Board. |

| | | | Cboe Global Markets 2022 Proxy Statement

| 9

|

Ivan K. Fong Independent Age: 6062 Committees:   Nominating and Governance Nominating and Governance

Risk Risk

| Background Mr. Fong has served on our Board since December 2020. Mr. Fong is currently Executive Vice President, General Counsel and Secretary of Medtronic plc, a position he has held from February 2022. Prior to this position, he served as Senior Vice President, Chief Legal and Policy Officer and Secretary of 3M Company from 2019 to January 2022 and as its Senior Vice President, Legal Affairs and General Counsel from 2012 to 2019. Prior to joining 3M Company, Mr. Fong was General Counsel of the U.S. Department of Homeland Security from 2009 to 2012 and Chief Legal Officer and Secretary of Cardinal Health, Inc. from 2005 to 2009. He has previously served as Deputy Associate Attorney General with the U.S. Department of Justice and was a partner with the law firm of Covington & Burling LLP. Mr. Fong holds an S.B. degree in Chemical Engineering and an S.M. degree in Chemical Engineering Practice from Massachusetts Institute of Technology, a J.D. degree from Stanford University, and a Bachelor of Civil Law from Oxford University. Qualifications Mr. Fong brings his experience as the general counsel of public companies, in private practice and as the former general counsel of a government department. He has extensive experience in corporate governance, government relations and the types of legal issues that public companies face, which we believe makes him well suited to serve on our Board. |

| | | 10 | Cboe Global Markets 2024 Proxy Statement | |

Janet P. Froetscher Independent Age: 6264 Committees:   Compensation Compensation

Nominating and Governance Nominating and Governance Executive Executive

Risk (Chair) Risk (Chair)

| Background Ms. Froetscher is Presidentcurrently the Chair and a Senior Advisor, since September 2023, of The J.B. and M.K. Pritzker Family Foundation, a position she has held sinceand was its President from April 2016 anduntil September 2023. She has served on the Board of Cboe Global Markets since our initial public offering in 2010 and of Cboe Options from 2005 to 2017. Previously, she served as President and CEO of Special Olympics International from October 2013 until October 2015, President and CEO of the National Safety Council from 2008 until October 2013, President and CEO of the United Way of Metropolitan Chicago and in a variety of roles at the Aspen Institute, most recently as Chief Operating Officer. From 1992 to 2000, Ms. Froetscher was the executive director of the Finance Research and Advisory Committee of the Commercial Club of Chicago. She alsoMs. Froetscher currently serves on the board of directors of the Independent Bank Group, a publicly traded company. She has also previously served on the board of trustees of National Louis University. Ms. Froetscher holds a B.A. degree from the University of Virginia and a Masters of Management from Northwestern University’sUniversity’s Kellogg School of Management. Ms. Froetscher is also a Henry Crown Fellow of the Aspen Institute. Qualifications Ms. Froetscher brings her experiences as the President of a family foundation and former CEO of public service entities to our Board. We believe that these experiences give her leadership, operational and community engagement skills that make her well suited to serve on our Board. |

| | | 10

| Cboe Global Markets 2022 Proxy Statement

| |

Jill R. Goodman Independent Age: 5557 Committees:   Executive Executive

Finance and Strategy (Chair) Finance and Strategy (Chair)

Nominating and Governance Nominating and Governance

| Background Ms. Goodman has served on our Board since 2012. Ms. Goodman is currently Managing Director of Foros, a strategic financial and mergers and acquisitions advisory firm, a position she has held since November 2013. Previously, she served as a Managing Director and Head, Special Committee and Fiduciary Practice—U.S. at Rothschild from 2010 to October 2013. From 1998 to 2010, Ms. Goodman was with Lazard in the Mergers & Acquisitions and Strategic Advisory Group, most recently as Managing Director. Ms. Goodman advises companies and special committees with regard to mergers and acquisitions. Ms. Goodman currently serves on the boards of directors of Cover Genius, a global insurance technology company, and publicly traded company Genworth Financial, Inc. Ms. Goodman graduated magna cum laude from Rice University with a B.A. degree. She received her J.D. degree, with honors, from the University of Chicago Law School. Qualifications Ms. Goodman brings extensive experience in the boardroom to the Company. Her experiences, both as an investment banker and her corporate and securities legal background, bring a unique insight with which to consider our opportunities. We believe that these experiences give her knowledge and skills that make her well suited to serve on our Board. |

| | | | Cboe Global Markets 2024 Proxy Statement | 11 |

Erin A. Mansfield Independent Age: 64 Committees:  ATS Oversight ATS Oversight

Risk Risk

| Background Ms. Mansfield has served on our Board since 2024. Ms. Mansfield is a retired Managing Director from Barclays PLC, a position she held from 2003 to 2023, where she served in multiple roles, including Global Head of Regulatory Relations & Policy, Global Head of Investment Banking Compliance and Chief Compliance Officer Americas. Prior to her time with Barclays, Ms. Mansfield was a Vice President at Goldman Sachs & Co. LLC in their Fixed Income, Currencies & Commodities group. Ms. Mansfield holds a B.A. degree from Vassar College. Qualifications Ms. Mansfield has a strong understanding of our business, financial markets, products, compliance and the regulation of the financial and derivatives industries from her leadership positions at key financial institutions. We believe that her experience makes her well suited to serve on our Board. | Cecilia H. Mao Independent Age: 49 Committees:  Finance and Strategy Finance and Strategy

| Background Ms. Mao has served on our Board since 2024. Ms. Mao is currently Global Chief Product Officer at Equifax, having served in this position since 2020. Previously, Ms. Mao was with Oracle Corp. from 2014 to 2020, holding multiple positions including Director, Senior Director, and Vice President of Oracle Data Cloud. Prior to her time at Oracle Corp., Ms. Mao held management positions at Verisk Analytics, FICO, and other technology companies. Ms. Mao graduated from the University of California, Berkeley with a B.A. degree. Qualifications As an experienced leader, Ms. Mao’s positions at Equifax and Oracle give her unique insights into all aspects of corporate growth, enterprise management, and technology. Ms. Mao has a deep understanding of revenue acceleration and adapting to new strategic opportunities. We believe that her experience makes her well suited to serve on our Board. |

| | | 12 | Cboe Global Markets 2024 Proxy Statement | |

Alexander J. Matturri, Jr. Independent Age: 6365 Committees:   ATS Oversight (Chair) ATS Oversight (Chair)

Audit Audit

| Background Mr. Matturri has served on our Board since December 2020. Mr. Matturri is the retired Chief Executive Officer of S&P Dow Jones Indices LLC (“S&P”), a position he held from July 2012 to June 2020. Prior to this position, he served as Executive Managing Director and Head of S&P Indices from 2007 to 2012. Prior to joining S&P, Mr. Matturri served as Senior Vice President and Director of Global Equity Index Management at Northern Trust Global Investments from 2003 to 2007. From 2000 to 2003 he was Director and Senior Index Investment Strategist at Deutsche Asset Management. Mr. Matturri is currentlyalso previously served as a member of the boards of directors of our securities exchanges. Mr. Matturri holds a B.S. degree in Finance from Lehigh University and a J.D. degree from Syracuse University. Mr. Matturri holds the Chartered Financial Analyst designation. Qualifications As the retired CEO of a financial services industry company and a former member of the boards of directors of our securities exchanges, Mr. Matturri has extensive knowledge of financial markets, products, and the financial services and banking industry. In particular, he has a close understanding of one of our most important licensing arrangements. We believe that these experiences make him well suited to serve on our Board. |

| | | | Cboe Global Markets 2022 Proxy Statement

| 11

|

Jennifer J. McPeek Independent Age: 5254 Committees:   ATS Oversight ATS Oversight

Audit Audit

| Background Ms. McPeek has served on our Board since August 2020. Ms. McPeek is an independent advisor to companies on value-based management and incentive design. Previously, she has served as the Chief Financial Officer of Russell Investments from 2018 to 2019. From 2009 to 2017, Ms. McPeek was with Janus Henderson Investors plc and its predecessor company Janus Capital Group Inc., serving as the Chief Financial Officer from 2013 to 2017, and as the Chief Operating and Strategy Officer post-merger in 2017. Prior to that, Ms. McPeek was with ING Investment Management, Americas from 2005 to 2009, where she was a member of the management committee and led the strategy function. Ms. McPeek currently serves on the board of directors of First American Funds, Inc., overseeing six money market funds. She graduated magna cum laude from Duke University with an A.B. degree in Mathematics and Economics and received her M.S. degree in Financial Engineering from the MIT Sloan School of Management. Ms. McPeek holds the Chartered Financial Analyst designation. Qualifications As the former CFO of privately held and publicly traded asset management companies, Ms. McPeek has extensive experience with finance, public company responsibilities, strategic transactions and knowledge of our industry. In addition, her service on another company board also gives Ms. McPeek experience with corporate governance and leadership skills. We believe that her experience makes her well suited to serve on our Board. |

| | | | 12

Cboe Global Markets 20222024 Proxy Statement | 13 |

Roderick A. Palmore

Independent

Age: 70

72

Committees:

Executive Executive

Finance and Strategy Finance and Strategy

Nominating and Nominating and

Governance (Chair)

| Background Mr. Palmore is Senior Counsel at Dentons where he advises public and private corporations and their leadership suites on risk management and governance issues across practices and industry sectors. Mr. Palmore retired from his position as Executive Vice President, General Counsel and Chief Compliance and Risk Management Officer of General Mills, Inc. in February 2015 and has served on the Board of Cboe Global Markets since our initial public offering in 2010 and of Cboe Options from 2000 to 2017. Prior to joining General Mills in February 2008, he served as Executive Vice President and General Counsel of Sara Lee Corporation. Before joining Sara Lee, Mr. Palmore served in the U.S. Attorney’s Office in Chicago and in private practice. Mr. Palmore is currently a member of the board of directors of publicly traded company The Goodyear Tire & Rubber Company and has previously served as a member of the boards of directors of Express Scripts Holding Company, formerly a publicly traded company, Nuveen Investments, Inc. and the United Way of Metropolitan Chicago. Mr. Palmore holds a B.A. degree in Economics from Yale University and a J.D. degree from the University of Chicago Law School. Qualifications Through his experience as general counsel of public companies, in private practice and as an Assistant U.S. Attorney, Mr. Palmore has extensive experience in corporate governance and the legal issues facing the Company. In addition, his experience provides him with strong risk management skills. We believe that his experience makes him well suited to serve on our Board. |

| | | | Cboe Global Markets 2022 Proxy Statement

| 13

|

James E. Parisi

Independent

Age: 57

59

Committees:  ATS Oversight ATS Oversight

Audit (Chair) Audit (Chair)

Compensation Compensation

Executive Executive

| Background Mr. Parisi has served on our Board since 2018. Mr. Parisi most recently served as the Chief Financial Officer of CME Group Inc. from November 2004 to August 2014, prior to which he held positions of increasing responsibility and leadership within CME Group Inc. from 1988, including as Managing Director & Treasurer and Director, Planning & Finance. Mr. Parisi is currently a member of the board of directors of ATI Physical Therapy, Inc., a publicly traded company, andcompany. He has also previously served as the Chairman of the Illinois Special Olympics Foundation Board. He has also previously servedBoard and as a member of the boards of directors of CFE and SEF, Pursuant Health Inc., and Cotiviti Holdings, Inc., formerly a publicly traded company. Mr. Parisi holds a B.S. degree in Finance from the University of Illinois and an M.B.A. degree from the University of Chicago. Qualifications As the retired CFO of a publicly traded company offering a diverse derivatives marketplace and as a former member of the boards of directors of CFE and SEF, Mr. Parisi has extensive knowledge of our industry. His service on other company boards also gives Mr. Parisi experience with corporate governance and leadership skills. We believe that his experience makes him well suited to serve on our Board. | Joseph P. Ratterman

Independent

Age: 55

Committees:

ATS Oversight (Chair) ATS Oversight (Chair)

Finance and Strategy Finance and Strategy

| Background

Mr. Ratterman has served on our Board since 2017 in connection with the closing of the acquisition of Bats. Mr. Ratterman was one of Bats’ founders in 2005, and served as Chairman of Bats from 2015 until our acquisition of Bats. Mr. Ratterman also served as its Chairman from June 2007 until July 2012, as President from June 2007 until November 2014 and as CEO from June 2007 until March 2015. Mr. Ratterman is a member of the SEC’s Equity Market Structure Advisory Committee and a member of the board of directors of Axoni. Mr. Ratterman holds a B.S. degree in Mathematics and Computer Science from Central Missouri State University.

Qualifications

Mr. Ratterman, as the former Chairman and CEO of Bats, brings significant knowledge of Bats, a large component of the Company, and the securities and futures industry. In addition to serving at Bats, he has extensive experience in a similar capacity with another industry participant. We believe that his experience in our industry makes him well suited to serve on our Board. His experience allows him to provide our Board a unique perspective on our business, competition and regulatory concerns.

|

| | | 14

| Cboe Global Markets 2022 Proxy Statement

| |

Jill E. Sommers

Independent

Age: 53

Committees:

Nominating and Governance Nominating and Governance

Risk Risk

| Background

Ms. Sommers has served on our Board since 2018. Ms. Sommers is currently a senior advisor to Patomak Global Partners, a financial services consultancy group, a position she has held since 2014. Previously, Ms. Sommers served as a commissioner of the Commodities Futures Trading Commission (“CFTC”) from 2007 to 2013 and as a member of the boards of directors of the securities exchanges of Bats from 2013 through the time of our acquisition of Bats in 2017. Ms. Sommers is currently a member of the boards of directors of CFE, SEF, and the Ethics and Compliance Initiative and a member of the advisory board of directors of Green Key Technologies. She has also previously served as a member of the boards of directors of our securities exchanges. Ms. Sommers holds a B.A. degree in Political Science from the University of Kansas.

Qualifications

Ms. Sommers has a strong understanding of our business and the regulation of the financial and derivatives industries from her experience with the CFTC, as a member of the boards of directors of CFE and SEF and a former member of the boards of directors of our securities exchanges. These skills, as well as her experience on other boards, make her well suited to serve on our Board.

|

| | | | Cboe Global Markets 2022 Proxy Statement

| 15

|

Fredric J. Tomczyk

Independent

Age: 66

Committees:

Compensation Compensation

Finance and Strategy Finance and Strategy

| Background

Mr. Tomczyk has served on our Board since July 2019. He is the retired President and Chief Executive Officer of TD Ameritrade Holding Corporation, a position he held from October 2008 to October 2016. Prior to this position, he held positions of increasing responsibility and leadership with the TD organization from 1999. Mr. Tomczyk was also a member of the TD Ameritrade board of directors from 2006 to 2007 and 2008 to 2016. Prior to joining the TD organization in 1999, Mr. Tomczyk was President and Chief Executive Officer of London Life. He currently serves as the lead independent director of Sagan MI Canada Inc., a publicly traded company, and of its operating subsidiary Sagan Mortgage Insurance Company Canada and is a member of the Cornell University Athletic Alumni Advisory Council. Mr. Tomczyk also served as a director of Knight Capital Group, Inc. and as a trustee of Liberty Property Trust, both formerly publicly traded companies, and as a director of the Securities Industry and Financial Markets Association. Mr. Tomczyk holds a B.S. degree in Applied Economics & Business Management from Cornell University and is a Fellow of the Institute of Chartered Accountants of Ontario.

Qualifications

As the retired President and CEO of a public financial services industry company, Mr. Tomczyk has extensive knowledge of the financial markets, technology and the financial services and banking industry. His service on TD Ameritrade’s and other company boards also gives Mr. Tomczyk experience with corporate governance and leadership skills. We believe that these experiences make him well suited to serve on our Board.

|

Each director nominee must receive the affirmative vote of a majority of the votes cast with respect to his or her election in order to be elected. Each nominee has tendered his or her resignation, contingent on failing to receive a majority of the votes cast in this election and acceptance by the Board. In the event any director fails to receive a majority of votes cast, the Nominating and Governance Committee will consider and make a recommendation to the Board as to whether to accept the resignation. Abstentions and broker non-votes will not be counted as votes cast and therefore will not affect the vote.

The Board recommends that the stockholders vote FOR each of the director nominees.

| | | 1614

| Cboe Global Markets 20222024 Proxy Statement | |

Board Structure Independence Our Bylaws require that, at all times, no less than two-thirds of our directors will be independent. The Nominating and Governance Committee has affirmatively determined that all of our current directors serving in 2023, except for Mr. Tomczyk since his appointment as CEO in September 18, 2023 and Edward T. Tilly, who resigned as a Chairman and CEO effective September 18, 2023, are independent under BZX listing standards for independence. In addition, Michael L. Richter,Joseph P. Ratterman who did not stand for reelectionresigned as a director in 2021,effective February 5, 2024, was determined to be independent through May 13, 2021. In determining the independence of Mr. Ratterman, the Nominating and Governance Committee considered that Mr. Ratterman recently sold farmland to Mr. Isaacson, one of our executive officers, and that a family member of Mr. Isaacson has previously been under a contract to farm the same land. Mr. Isaacson is not a party to such farming contract and is not aware of its terms. The purchase of the farmland and the farming contract were each found to be consistent with ordinary market terms and did not involve businesses that compete with Cboe.February 5, 2024.

All of the directors then serving on each of the Audit, Compensation, and Nominating and Governance Committees are independent. Each of these Committees (as defined below) reports to the Board as they deem appropriate, and as the Board may request. Lead DirectorNon-Executive Chairman

The Board has an independent Lead Director,Non-Executive Chairman, Mr. Sunshine.Farrow. Our Corporate Governance Guidelines require that an independent director serve as our Lead Director.Director or Non-Executive Chairman, as applicable. The Lead Directorposition is annually elected by the Board, upon the recommendation of the Nominating and Governance Committee. TheCommittee, however, it is expected that the elected director will serve 4 years, which may be extended in extraordinary circumstances. Under our Bylaws, the Chairman shall be the presiding officer at all meetings of the Board and stockholders and shall exercise such other powers and perform such other duties as are delegated to the Chairman by the Board. Additionally, the Charter of the Lead Director,Director/Non-Executive Chairman, Appendix A to our Corporate Governance Guidelines, provides thatfor the Lead Director’sfollowing responsibilities, include, among other items:   Chair all meetings of the non-employee and independent directors of the Board, including the executive sessions; Chair all meetings of the non-employee and independent directors of the Board, including the executive sessions;

Approve agendas for Board meetings and consult with the Approve agendas for Board meetings and consult with the ChairmanCEO on other matters pertinent to us and the Board;

Serve as a liaison between the Serve as a liaison between the ChairmanCEO and the independent Directors;

Approve meeting schedules to assure that there is sufficient time for discussion of all agenda items; Approve meeting schedules to assure that there is sufficient time for discussion of all agenda items;

Advise and consult with the Advise and consult with the Chairman and CEO on the general scope and type of information to be provided in advance of Board meetings;

In collaboration with the In collaboration with the Chairman and CEO, consult with the appropriate members of senior management about what information pertaining to our finances, operations, strategic alternatives, and compliance is to be sent to the Board; and

To perform other duties as the Board may determine. To perform other duties as the Board may determine.

| | | | Cboe Global Markets 20222024 Proxy Statement | 1715

|

Chairman and CEO Roles Since 2017, in connection with the closing of the acquisition of Bats, we combined the roles of Chairman and CEO, with Mr. Tilly serving as the Chairman and CEO. Mr. Tilly was also appointed President effective January 14, 2019 and is expected to step down as President effective May 12, 2022 in connection with the appointment of David Howson to the role of President to be effective on the same day. The Board carefully considers its Board leadership structure and the benefits of continuity in leadership roles and continuesbelieves having Mr. Farrow serve in the role of Non-Executive Chairman at this time, as opposed to believe thatcontinuing the combined roles of Chairman and CEO at this timeMr. Tilly held prior to his resignation, enhances the Company’s strategic alignment and supports Cboe Global Markets’ ability to deliver stockholder value.

The Board periodically reviews the leadership structure and may make changes in the future based upon what the Board believes to be in the best interests of the Company and stockholders at the time. At certain points in our history, the Chairman and CEO roles have been held by the same person, and at other times, the roles have been held by different individuals. Under our Bylaws, the Chairman may, but need not be, our CEO, and the Board believes it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairman and CEO in any way that is in the best interests of the Company and stockholders at a given point in time based upon then-prevailing circumstances. The Board believes that the decision as to who should serve in those roles, and whether the offices should be combined or separate, should be assessed periodically by the Board, and that the Board should not be constrained by a rigid policy mandate when making these determinations. In addition, our Board has implemented the following elements in order to help ensure independent oversight for us and for our Board:  requiring requiring Requiring the Board to consist of at least two-thirds independent directors who meet regularly without management and solely with non-employee and independent Requiring the Board to consist of at least two-thirds independent directors who meet regularly without management and solely with non-employee and independent directors,directors;

establishing establishing Establishing independent Audit, Compensation, and Nominating and Governance Establishing independent Audit, Compensation, and Nominating and Governance Committees,Committees; and

appointing appointing Appointing an independent Lead Appointing an independent Lead Director.Director or Non-Executive Chairman, as applicable.

Board Oversight of Human Capital and Succession Planning The Board recognizes that our business depends on associateemployee productivity, development, and engagement. In particular, the Board and Compensation Committee each receives updates and reports on diversity and inclusion and associateemployee engagement from management, including from the Company’sCompany’s Chief Human Resources Officer. More specifically, the Compensation Committee has been delegated the responsibility to oversee the policies and strategies relating to talent, leadership, and culture, including diversity and inclusion. The Compensation Committee receives presentations throughout the year on human resources matters, including succession planning, diversity and inclusion initiatives, diversity metrics, attrition and associateretention metrics, and employee engagement surveys.survey results. Further, summaries of the proceedings from prior Compensation Committee meetings are provided to the Board on a routine basis, including on a quarterly basis. The Board further believes that providing for effective continuity of leadership is central to our long-term growth strategy. The succession planning process includes consideration of ordinary course succession and planning for situations where executives unexpectedly become unable to perform their duties. Executive succession planning is an ongoing process, reviewed and discussed on at least an annual basis by the Compensation Committee. The Compensation Committee reviews the Company’s organizational chart for potential successors. Summaries of these proceedings from prior Compensation Committee meetings are provided to the Board on a routine basis, including on a quarterly basis. The Board also reviews reports about executive succession and undergoes other relevant evaluations on an as needed basis. | | | 1816

| Cboe Global Markets 20222024 Proxy Statement | |

In addition, Board succession planning is evaluated regularly within the Nominating and Governance Committee, whose reports and other necessary action items are discussed and acted upon by the Board as a whole. For more information see “Committees of the Board—Nominating and Governance Committee” below. Board Oversight of Environmental, Social, and Governance Matters The Board recognizes that operating in a socially responsible manner helps promote the long-term interests of our stockholders, organization, associates,employees, industry, and community. As such, the Board stays apprised of particular environmental, social, and governance (“ESG”)ESG matters in accordance with its general oversight responsibilities. The Board has delegated to the Committees oversight over the following specific areas and all Committees report to the full Board on a routine basis, including on a quarterly basis, and when a matter rises to the level of a material or enterprise level. For more information about Committee responsibilities, see also “Committees of the Board” below. For additional information regarding ESG, see “Corporate Governance—Corporate Social Responsibility”. | | Committee | Primary Areas of ESG Oversight | Audit |   ESG information contained in the annual and quarterly financial statements and related press releases ESG information contained in the annual and quarterly financial statements and related press releases

| Compensation |   Compensation, talent, leadership, and culture, including diversity and inclusion Compensation, talent, leadership, and culture, including diversity and inclusion

| Finance and Strategy |   Potential ESG impacts of acquisitions Potential ESG impacts of acquisitions

| Nominating and Governance |   General oversight of ESG program General oversight of ESG program

Corporate governance practices Corporate governance practices

| Risk |   Business and strategy risks, including ESG Business and strategy risks, including ESG

Environmental risks, including forces of nature and climate Environmental risks, including forces of nature and climate

|

In 2023, as set forth in further detail below in “Corporate Governance—Corporate Social Responsibility”, the Board and Committees, as applicable, were informed, among other items, of the annual ESG Report and Cboe’s ESG program. Board Oversight of Risk The Board is responsible for overseeing our risk management processes. The Board is responsible for overseeing our general risk management strategy, the risk mitigation strategies employed by management, including adequacy of resources, and the significant risks facing us, including, for example, competition, reputation, compliance, operational, and technology risks. The Board stays apprisedinformed of particular risk management matters in accordance with its general oversight responsibilities. The Board has delegated to the Committees oversight over the following specific areas and all Committees report to the full Board on a routine basis, including on a quarterly basis, and when a matter rises to the level of a material or | | | | Cboe Global Markets 20222024 Proxy Statement | 1917

|

matter rises to a material or enterprise level risk. For more information about Committee responsibilities, see “Committees of the Board” below. | |

|---|

Committee | Primary Areas of Risk Oversight |

|---|

ATS Oversight |   Business and operation of BIDS Business and operation of BIDS Trading’sTrading, L.P.’s (“BIDS Trading’s”) U.S. equities businesses

Adequacy and effectiveness of separation protocols between Cboe Global Markets and BIDS Trading’s U.S. equities businesses Adequacy and effectiveness of separation protocols between Cboe Global Markets and BIDS Trading’s U.S. equities businesses

| Audit |   Adequacy and effectiveness of internal controls and procedures Adequacy and effectiveness of internal controls and procedures

Financial reporting and taxation Financial reporting and taxation

| Compensation |   Compensation policies and procedures Compensation policies and procedures

| Finance and Strategy |   Credit and capital structure Credit and capital structure

Strategic challenges with business partners Strategic challenges with business partners

| Nominating and Governance |   Corporate governance practices Corporate governance practices

| Risk |   Enterprise risk management Enterprise risk management

Information security Information security

Operational risks relating to internal processes, people or systems, including information technology Operational risks relating to internal processes, people or systems, including information technology

Compliance, environmental, legal and regulatory risks Compliance, environmental, legal and regulatory risks

|

In addition to our Board, our management is responsible for daily risk management. To help achieve this goal, we have adopted an enterprise risk management framework that is supported by a three lines of defense approach, which involve the Business, Risk Management and Information Security Department, Enterprise Risk Management Committee, Compliance Department, Internal Audit Department, and the | | | 2018

| Cboe Global Markets 20222024 Proxy Statement | |

Department, and the Board and Committees. We believe the following division of risk management responsibilities is an effective approach for addressing the enterprise risks that we face.

| | Line of Defense | Description | First |   Our Business managers and Our Business managers and associates,employees, which are responsible for the performance, supervision and/or monitoring of our policies and control procedures

| Second |   Compliance and Risk Management and Information Security Departments, which provide independent oversight by assessing first line risk, advising management on policies, procedures, and controls to mitigate identified risks, and monitoring and reporting on any identified deficiencies or control enhancements Compliance and Risk Management and Information Security Departments, which provide independent oversight by assessing first line risk, advising management on policies, procedures, and controls to mitigate identified risks, and monitoring and reporting on any identified deficiencies or control enhancements

Enterprise Risk Management Committee, composed of representatives of each of our departments, which meets periodically to review an established matrix of identified risks to evaluate the level of potential risks facing us and to identify any significant new risks Enterprise Risk Management Committee, composed of representatives of each of our departments, which meets periodically to review an established matrix of identified risks to evaluate the level of potential risks facing us and to identify any significant new risks

Enterprise Risk Management Committee, along with our Chief Risk Officer, provide information and recommendations to the Risk Committee as necessary Enterprise Risk Management Committee, along with our Chief Risk Officer, provide information and recommendations to the Risk Committee as necessary

| Third |   Internal Audit Department, which provides additional independent assurance that significant risks and related policies, procedures, and controls are reasonably designed and operating effectively Internal Audit Department, which provides additional independent assurance that significant risks and related policies, procedures, and controls are reasonably designed and operating effectively

|

Board Oversight of Information Security The Board recognizes that our business depends on the confidentiality, integrity, availability, performance, security, and reliability of our data and technology systems and devotes time and attention to the oversight of cybersecurity and information security risk. In particular, the Board and Risk Committee each receives updates and reports on information security from senior management, including from the Company’s Chief Compliance Officer, Chief Risk Officer, and Chief Information Security Officer. More specifically, the Risk Committee receives presentations from senior management throughout the year, including on a quarterly basis, on cybersecurity, including architecture and resiliency, incident management, business continuity and disaster recovery, significant information technology changes, data privacy, insider threat, physical security, and information related to third-party assessments conducted by leading information security providers of the Company’s information security program.program, and risks associated with the use of third party service providers. The Risk Committee also receives quarterly reports regarding the overall status of the Company’s information security strategy and program, including adequacy of staffing and resources, and reviews and approves any changes to the related information security charter. Further, summaries of the proceedings from prior Risk Committee meetings are provided to the Board on a routine basis, including on a quarterly basis. Board Oversight of COVID-19 Global Pandemic

In 2021, the Board continued to oversee risks in the wake of the COVID-19 global pandemic. The Board monitored developments around COVID-19 and facilitated frequent communications with management. These Board meetings focused on updates regarding impacts to business continuity, associates, customers, regulators, trading behaviors and volumes, open outcry trading, market disruptions, demand for our products, market data, critical vendors, technology equipment suppliers, and data and disaster recovery centers. In addition, our 2023 Annual Report to Stockholders included in this mailing, which includes a copy of our Annual Report on Form 10-K for the Committeesyear ended December 31, 2023, also monitored developments around COVID-19, in particular, the Audit Committee focused on adequacy and effectiveness of internal controls and procedures, the Compensation Committee focused on compensation matterscontains relevant additional information under “Part I–Item 1C. Cybersecurity”.

| | | | Cboe Global Markets 20222024 Proxy Statement | 2119

|

and associate well-being and engagement, the Finance and Strategy Committee focused on liquidity and capital structure, and the Risk Committee focused on potential information security risks.

Board and Committee Meeting Attendance There were 1417 meetings of the Board during 2021.2023. Each director attended at least 75% of the aggregate number of meetings of the Board and meetings of Committees of which the director was a member during 2021.2023. Independent Directors Meetings Periodically, the independent directors meet separately in executive session without management. The Lead Director or Non-Executive Chairman, as applicable, presides over these meetings. The independent directors met in executive session 9separately without management 12 times during 2021.2023. Annual Meeting Attendance We encourage members of the Board to attend our annual meeting of stockholders. All of our current directors, who were then-serving on the Board, attended the 20212023 Annual Meeting of Stockholders.Stockholders, except for Mr. Parisi due to health reasons. Meetings of the Board and its Committees are being held in conjunction with the Annual Meeting. We expect all director nominees will attend the Annual Meeting. Committees of the Board Overview Our Board has the following standing committees (each, a “Committee” and collectively, the “Committees”):  the the The ATS Oversight Committee, The ATS Oversight Committee,

the the The Audit Committee, The Audit Committee,

the the The Compensation Committee, The Compensation Committee,

the the The Executive Committee, The Executive Committee,

the the The Finance and Strategy Committee, The Finance and Strategy Committee,

the the The Nominating and Governance Committee, and The Nominating and Governance Committee, and

the the The Risk Committee. The Risk Committee.

Other than the members of the Executive Committee required to be on such Committee pursuant to our Bylaws, each of the members of the Committees was recommended by the Nominating and Governance Committee for approval by the Board for service on that Committee. Each of the Committees has a charter and the Audit Committee, Compensation Committee, and Nominating and Governance Committee charters are available on the Corporate Governance page of our Investor Relations section of our website at: http://ir.Cboe.com. | | | 2220

| Cboe Global Markets 20222024 Proxy Statement | |

The following table is a listing of the composition of our standing Committees during 20212023 and as of March 17, 2022,15, 2024, including the number of meetings of each Committee during 2021.2023. | | | | | | | | Director | ATS Oversight | Audit | Compensation | Executive | Finance and Strategy | Nominating and Governance | Risk | Number of meetings | 6 | 10 | 11 | — | 9 | 7 | 7 | William M. Farrow, III | |  (1) (1)

| |  (1) (1)

|  (2) (2)

| |  (1) (1)

| Fredric J. Tomczyk (3) | | |  (3) (3)

|  (3) (3)

|  (3) (3)

| | | Edward J. Fitzpatrick | | |

|

| | |

| Ivan K. Fong | | | | | |

|

| Janet P. Froetscher | | |

|  (4) (4)

| |  (5) (5)

|  (6) (6)

| Jill R. Goodman | | | |

|

|

| | Erin A. Mansfield |  (2) (2)

| | | | | |  (2) (2)

| Cecilia H. Mao | | | | |  (2) (2)

| | | Alexander J. Matturri, Jr. |  (7) (7)

|

| | | | | | Jennifer J. McPeek |

|

| | | | | | Roderick A. Palmore | | | |

|

|

| | James E. Parisi |  (5) (5)

|

|

|

| | | | Joseph P. Ratterman (8) |  (8) (8)

| | | |  (8) (8)

| | | Edward T. Tilly (9) | | | |  (9) (9)

| | | | Eugene S. Sunshine (10) | | | |  (10) (10)

| | | |

Director | ATS Oversight | Audit | Compensation | Executive | Finance and Strategy | Nominating and Governance | Risk | Number of meetings | 11 | 11 | 7 | — | 11 | 7 | 6 | Edward T. Tilly (1) | | | |

| | | | Eugene S. Sunshine (1) | | | |

| |  (2) (2)

| | William M. Farrow, III | |

| |

| | |

| Edward J. Fitzpatrick | | |

|

| | |

| Ivan K. Fong | | | | | |  (3) (3)

|

| Janet P. Froetscher | | |

| | |

|

| Jill R. Goodman | | | |

|

|

| | Alexander J. Matturri, Jr. | |

| | | | | | Jennifer J. McPeek |

|

| | | | | | Roderick A. Palmore | | | |

|

|

| | James E. Parisi |

|

|

|

| | | | Joseph P. Ratterman |

| | | |

| | | Michael L. Richter (4) | |  (2) (2)

| | | | |  (2) (2)

| Jill E. Sommers | | | | | |

|  (3) (3)

| Fredric J. Tomczyk | | |

| |

| | |

= Chair = Chair   = Member = Member

| (1) | The Chairman,Effective May 11, 2023, Mr. Tilly,Farrow resigned from the Audit Committee and the Risk Committee. He also began to serve as independent Lead Director until his election to Chairman of the Board and Chairman of the Executive Committee, effective September 18, 2023. Mr. Sunshine, are both membersFarrow is an invited guest to the meetings of each of the other standing Committees. |

| (2) | Joined as a member of the Committee on February 8, 2024. |

| (3) | Effective September 18, 2023, Mr. Tomczyk resigned from the Compensation Committee and the Finance and Strategy Committee and became a member of the Executive Committee. Mr. TillyTomczyk is an invited guest to the meetings of each of the other standing Committees, other than the ATS Oversight Committee. Mr. Sunshine is an invited guest to the meetings of each of the other standing Committees. |

(2)(4) | Joined as a member of the Committee on May 11, 2023. |

| (5) | Stepped down as a member of the Committee on May 13, 2021.11, 2023. |

(3)(6) | JoinedEffective May 11, 2023, became Chair of the Committee on May 13, 2021.Risk Committee. |

(4)(7) | Effective February 8, 2024, became Chair of the ATS Oversight Committee. |

| (8) | Effective February 5, 2024, Mr. RichterRatterman resigned from the Board and Committees of which he was a member. |

| | | | Cboe Global Markets 2024 Proxy Statement | 21 |

| (9) | Effective September 18, 2023, Mr. Tilly resigned from the Board and Committees of which he was a member. Prior to his resignation, in his capacity as Chairman of the Board, Mr. Tilly served as Chair of the Executive Committee. |

| (10) | Mr. Sunshine stepped down as a member of the Board and Committees in connection with the 20212023 Annual Meeting of Stockholders on May 13, 2021.11, 2023. |

AuditIn addition, in August 2023 an ad hoc Special Committee

of the Board (the "Special Committee") was formed in connection with an investigation into personal relationships between Mr. Tilly and colleagues. The AuditSpecial Committee consistsmet 8 times during 2023 and consisted of 4 directors,7 directors: Mr. Farrow (Chair), Messrs. Fitzpatrick, Palmore, Parisi, and Ratterman and Mses. Froetscher and Goodman, all of whom are independent under BZX listing rules, as well as under Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”"Exchange Act"). Audit Committee The Audit Committee consists of 3 directors, all of whom are independent under BZX listing rules, as well as under Rule 10A-3 of the Exchange Act. The Audit Committee consists exclusively of directors who are financially literate. In addition, Mr. Parisi has been designated as our audit committee financial expert and meets the SEC definition of that position.

| | | | Cboe Global Markets 2022 Proxy Statement

| 23

|

The Audit Committee’s responsibilities include:  engaging engaging Engaging our independent auditor and overseeing its compensation, work, and performance, Engaging our independent auditor and overseeing its compensation, work, and performance,

reviewing reviewing Reviewing and discussing the annual and quarterly financial statements and related press releases with management and the independent auditor, Reviewing and discussing the annual and quarterly financial statements and related press releases with management and the independent auditor,